What is a small businesses?

There are a lot of definitions out there of what is a Small business. A small business takes form of a privately owned corporation, partnership, or sole proprietorship that usually has fewer employees and less annual revenue than a corporation or regular-sized business.

The definition of “small business” – in terms of being able to apply for government support and qualify for preferential tax incentives varies by country and industry.

Tax relief available

Government recognises the vital role of small businesses and budding entrepreneurs in the South African economy by providing for two categories of favourable tax dispensations for qualifying small businesses – these fall into two categories:

- Small business Corporations (with a gross annual income under R20 million) , and

- Micro businesses (with annual turnover less than R1 million).

1. Small business corporation (SBC)

In order to qualify as an SBC, an entity must meet the requirements stipulated in the

definition of “small business corporation” in the Income Tax Act. These requirements comprise four key areas, given below:

A legal entity requirement

One of the requirements in qualifying as an SBC is that the taxpayer must be a juristic person in the form of a –

- close corporation;

- co-operative;

- private company or

- personal liability

A holder of shares requirement

All the holders of shares or members, as appropriate, of a qualifying entity must, at all times during the relevant year of assessment, be natural persons. No part of the share capital or members interest of an SBC can therefore be held by a juristic person such as another company.

A contravention of this requirement, even if for one day during the year of assessment, will disqualify a qualifying entity from being an SBC for the year of assessment in which the requirement was not met, irrespective of whether all of the other requirements are

met.

The holders of shares in, or members of, the qualifying entity may not at any time during the particular year of assessment hold any shares or have any interest in the equity of any other “company”, except in those companies specifically permitted.

The reason for the limitation is to prohibit multiple shareholdings or arrangements which may be used to split income between various qualifying entities, thus providing taxpayers with an undue tax benefit.

A gross income limitation requirement

The gross income of a qualifying entity may not exceed R20 million for the particular year of assessment. An exception to this rule is when an entity carries on a trade for a period which is less than 12 months, the limitation of R20 million must be reduced proportionately.

The ratio applied to the R20 million limitation is the number of months the qualifying entity traded divided by 12. In determining the number of months during which a qualifying entity traded, a part of a month is treated as a full month.

A business activity requirement

The Income Act broadly imposes a limitation on the amount of income which may be generated from certain income streams, namely investment income and income generated from personal services.

An entity cannot qualify as an SBC if more than 20% of the total of all receipts and accruals (excluding capital receipts) and capital gains, consists of investment income and income from the rendering of a personal service.

A “personal service” is broadly described as service provided by a holder of an interest in the business in his personal capacity – some examples are the services provided by accountants, lawyers, architects, teachers, real estate brokers and personal advisors.

SBC Tax Allowances

Under this tax incentive, two sets of accelerated depreciation rates potentially apply to the assets of an SBC. Subject to certain conditions, assets used directly in a process of manufacture or a process of a similar nature may qualify for a 100% write-off in the year of assessment in which the asset is brought into use.

Assets that do not fall into this category may qualify for write-off over a period of three years at a rate of 50, 30 and 20% in the respective years.

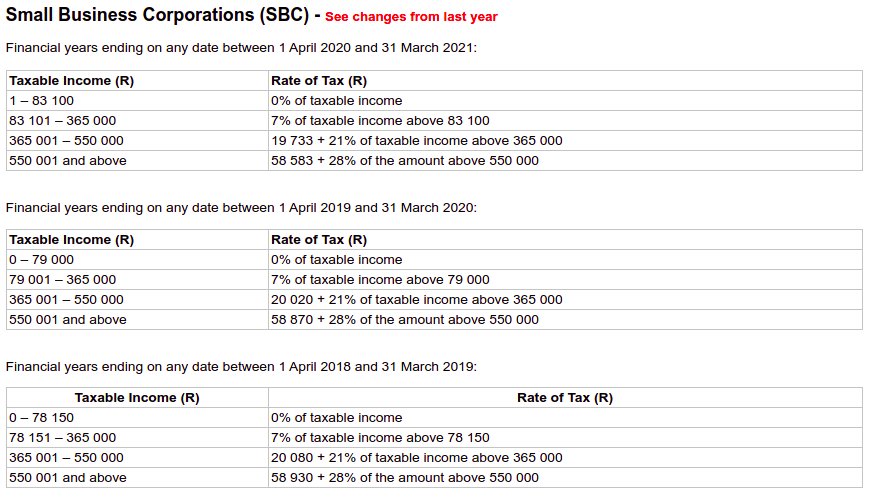

SBC Tax rates

2. Turnover tax

What is turnover tax?

Turnover Tax is a separate tax regime for micro businesses, that was designed to lower their administrative burden and with lower tax rates.

The turnover tax system replaces Income Tax, VAT, Provisional Tax, Capital Gains Tax and Dividends Tax for micro businesses with a qualifying annual turnover of R 1 million or less.

Who is it for?

Micro businesses with an annual turnover of R 1 million or less. The following taxpayers may qualify:

- Individuals (sole proprietors)

- Partnerships

- Close corporations

- Companies

- Co-operatives

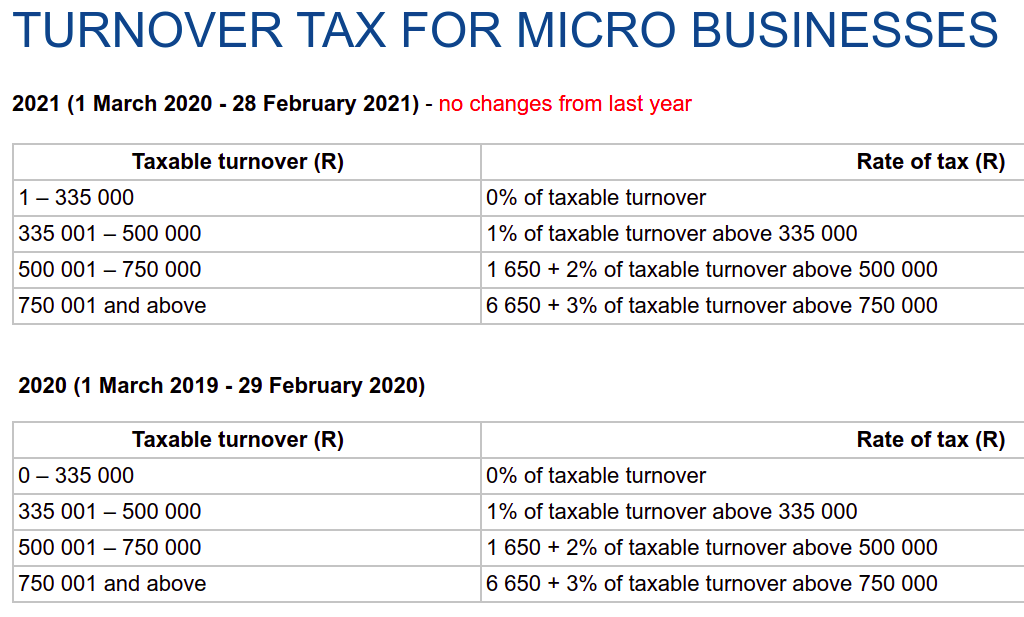

Turnover tax Rates

Want to take advantage of these tax incentives?

To receive updates of posted on this website subscribe to our newsletter below