What is an annual return?

An Annual Return is a statutory return in terms of the Companies and Close Corporations Acts and therefore MUST be complied with.

The purpose for the filing of such annual returns is to confirm whether a company or close corporation is still in business or trading, or if it will be in business in the near future.

The annual return may be regarded as a type of annual “renewal” of the company or close corporation registration.

Therefore, if annual returns are not filed within the prescribed time period, the assumption is that the company or close corporation is inactive, and as such CIPC will start the de-registration process to remove the company or close corporation from its active records.

Who must file Annual Returns?

All companies (including external companies) and close corporations are required by law to lodge their Annual Returns with CIPC every year. The annual returns must be filed by the company or close corporation or its duly authorised representative that is in a position to provide the required information.

When must the Annual Returns be filed?

All companies (including external companies) and close corporations are required by law to lodge their Annual Returns with CIPC within a certain period of time every year. Annual Returns filing differs for companies and close corporations.

Companies must file (regardless as to whether it was active or not) within 30 business days starting from the anniversary day after its date of registration. For example if a company was registered on the 20th of March 2020, the annual returns should be filed between 21 March of 2021 – 04 May 2021 before a penalty can be incurred.

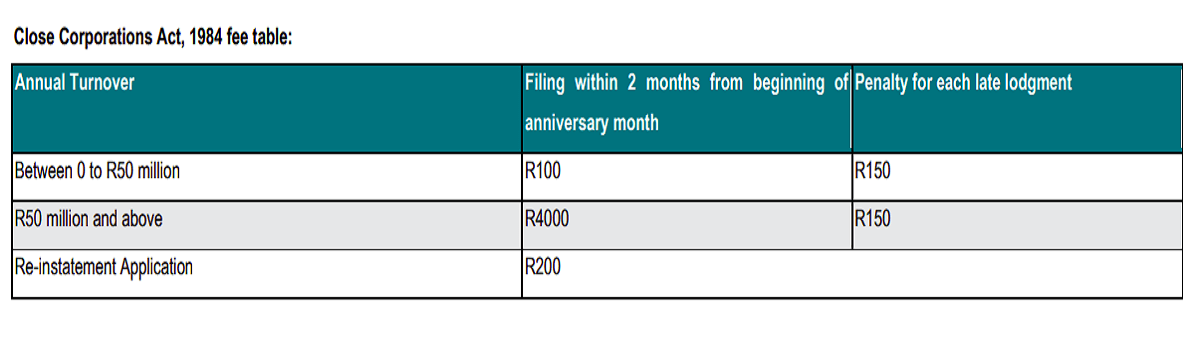

Close corporations must file (again regardless as to whether it was active or not) starting from the first day of the month it was registered up until the month thereafter. It may still file after such period, but an additional penalty fee will be applicable. For example if the close corporation was registered on the 20th of March 2002, the annual returns should be filed on the 1st of March every year failure of which will result in a penalty being incurred.

A company or close corporation that has failed to file an annual return for two or more years in succession may be de-registered.

What are the fees for the Annual Returns?

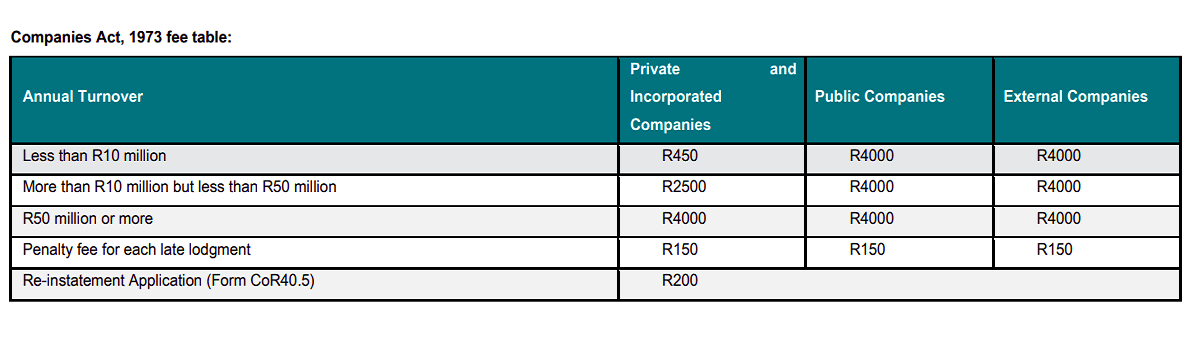

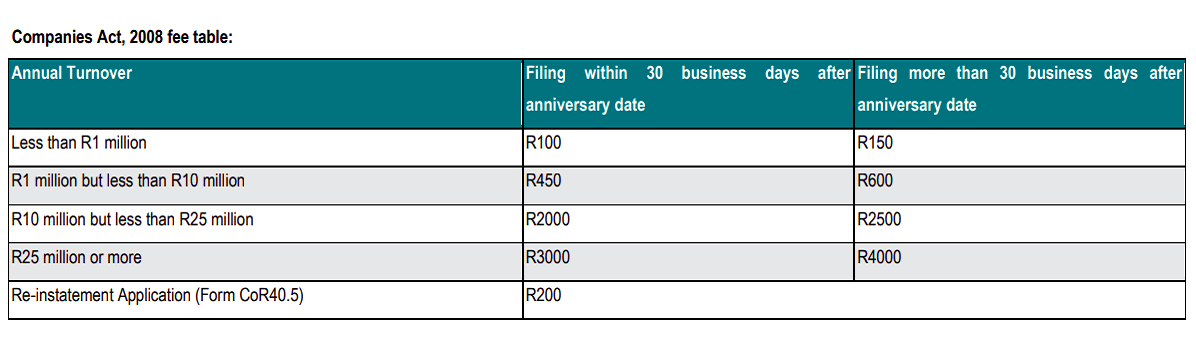

The following table gives a guide of the fees that may be payable when Annual returns are filed. The table below is given to give a guide of how much an entity may pay but the actual fee is determined by CIPC upon filing the return.

If the annual return became due on 1 May 2011 or thereafter, the fee structure under the Companies Act, 2008 must be used. If it became due before 1 May 2011, the fee

structure under the Companies Act, 1973 must be used.

What is the role of an accountant in filing the annual returns?

Your accountant is in a position to assist you with the filing of your annual returns. The accountant will provide you with the turnover figures required in the determination of the annual returns fee or they will file the annual returns on behalf of business owner.

What are the consequences of not filing your Annual Returns?

The CIPC will assume that the company or close corporation is inactive, and as such CIPC will start the de-registration process to remove the company or close corporation from its active records. The legal effect of the de-registration process is that the juristic personality is withdrawn and the company or close corporation ceases to exist.

Conclusion

It very important to ensure that your company or close corporation’s annual returns are filed within the prescribed time frames to maintain its active status.

Do you require assistance with filing your annual returns?