The Benefits of Cash Flow Forecasting

In Part 1 and Part 2 we established the critical role of cash flow in business operations, let’s explore the tangible advantages of cash flow forecasting. This proactive financial practice empowers businesses, especially growing ones, in several significant ways:

1. Improved Financial Control:

Cash flow forecasting gives you greater control over your finances. By predicting future cash inflows and outflows, you can identify potential shortfalls or surpluses in advance. This allows you to make informed decisions to maintain a healthy cash position.

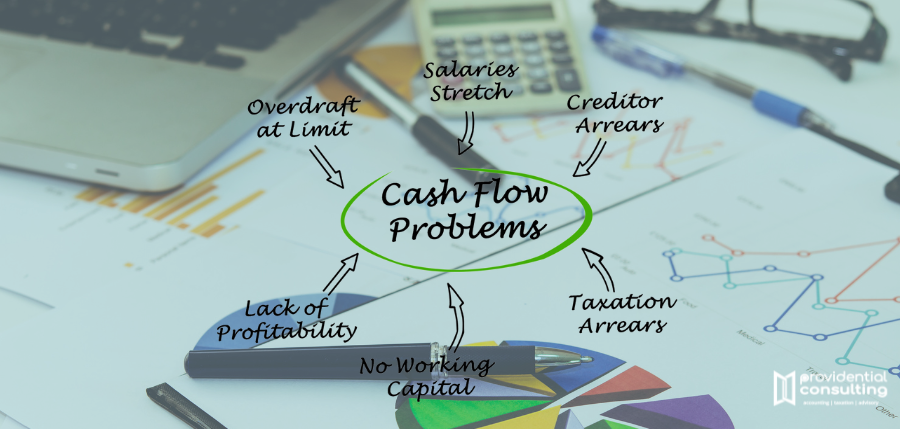

2. Early Problem Detection:

Forecasting helps you identify financial issues before they escalate. Whether it’s a slowdown in sales, delayed customer payments, or unexpected expenses, early detection enables you to take corrective action promptly, minimizing the impact on your business.

3. Strategic Planning:

A cash flow forecast serves as a strategic planning tool. It allows you to align your business objectives with your financial capabilities. You can allocate resources more effectively, plan for growth initiatives, and set realistic financial goals.

4. Better Resource Allocation:

With a clear view of your cash flow, you can allocate resources where they are needed most. Whether it’s prioritizing investments in marketing, equipment upgrades, or debt reduction, cash flow forecasting guides your resource allocation decisions.

5. Enhanced Financing Decisions:

When seeking external financing or loans, lenders and investors often request cash flow forecasts. Providing accurate forecasts demonstrates your ability to manage debt and repayments, increasing your credibility and the likelihood of securing funding.

6. Risk Mitigation:

Cash flow forecasting helps you assess and mitigate financial risks. By identifying potential cash shortages, you can implement risk management strategies such as establishing credit lines or building cash reserves.

7. Supplier Relationships:

Timely payments to vendors and suppliers are essential for a smooth supply chain. Cash flow forecasting ensures you have the funds available to honor your commitments, strengthening relationships and potentially negotiating better terms.

8. Employee Confidence:

A stable cash flow situation instills confidence among your employees. They can count on consistent salaries and job security, fostering a positive work environment.

9. Competitive Advantage:

Businesses that can anticipate and adapt to changing financial circumstances gain a competitive edge. Cash flow forecasting allows you to stay ahead of the curve, making you more agile in the marketplace.

10. Peace of Mind:

Perhaps one of the most significant advantages of cash flow forecasting is the peace of mind it offers. Knowing you have a clear financial roadmap and the ability to weather financial challenges reduces stress and anxiety for business owners and stakeholders.

Conclusion

Incorporating cash flow forecasting into your business practices provides a holistic view of your financial health. It equips you with the tools to make proactive financial decisions, seize growth opportunities, and ensure the long-term success of your growing business.

In the Part 4, we will delve into the steps involved in creating an effective cash flow forecast, enabling you to harness these advantages effectively.

What To Do Next?

- You can complete our online form and we will call you.

- You can book an appointment to engage further.